Buying your first home can seem like a daunting task– where do you begin in what may be the largest financial investment of your lifetime? This process is not only elusive, but confusing for folks who are just starting to think about buying a home.

That’s where I come in: having worked with many first-time homeowners, buying a home doesn’t have to be the most stressful experience in your life. My job is to increase transparency and clarity by shepherding my clients from the first stage all the way through closing day. So where do we begin?

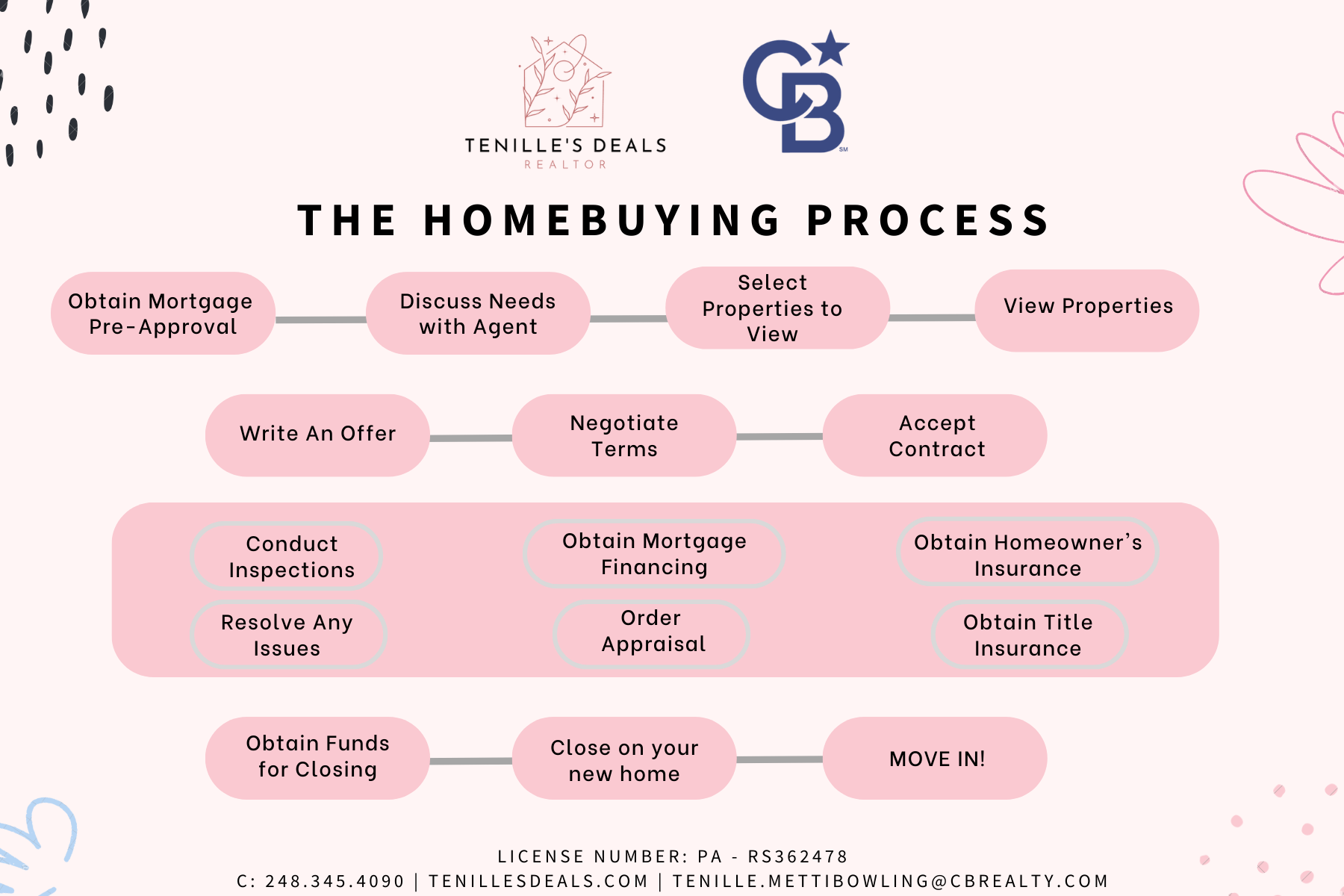

A visual depiction of the homebuying process, each step explained below!

Step 1: Obtain Mortgage Pre-Approval or Provide Proof of Funds

Understanding how you will finance the home is the most important first step a prospective buyer can take. This will not only help you realistically understand what your budget is, but in the event that you see a home and need to act fast in submitting an offer, lenders will already have the information they need to speed up the process following your offer getting submitted. In addition, as realtors, we are required to send mortgage pre-approval letters with any offer we submit.

For folks that are planning on submitting a cash offer, they still need to provide proof of funds to their realtor. For cash offers, proof of funds is required to send with any offer we submit. This can be a letter from your banking institution verifying that you have the funds available or as simple as a screenshot of an account demonstrating that funds are available.

Step 2: Discuss Your Needs With Your Agent

Looking for a fenced-in yard? A clawfoot tub? Detached garage? Once you have a sense for your budget, now is that time to chat with your agent about need-to-have’s versus nice-to-have’s for your property search. This will allow your agent to get you added to MLS emails so you are alerted each day a property that fits your criteria hits the market– keeping you updated, informed, and potentially first-in-line to see any homes you’re falling in love with!

Step 3: Select Properties to View

Excited about that one 3 bedroom ranch that just got listed in your favorite neighborhood? Reach out to your realtor and get something scheduled to see it in person.

Step 4: View Properties

This is the fun part! See the home and decide if it’s “the one!”

Step 5: Write An Offer

Work closely with your realtor to discuss everything from purchase price, closing date, and any contingencies (like home inspection) that you’d like to write with your offer. Your realtor can walk you through all of the key pieces.

I personally like to meet up with my first-time homeowners in-person over coffee or a drink to walk them through the entire offer– it’s a lot of paperwork but it’s really critical that buyers understand what they’re signing!

Step 6: Negotiate Terms

Your realtor will let you know when the seller responds, perhaps with a counter-offer on terms including anything from purchase price, closing date, or other specifics written in your offer. Together with your realtor, you will decide how to respond to the seller’s counter.

Step 7: Accept Contract

Yay! Signed, sealed, delivered– you’ve got your offer accepted! You’re officially under contract for your new home. But don’t kick back: there are many steps ahead that you are responsible for moving forward in the lead up to closing day.

Step 8: Simultaneously Advance Inspections, Financing, and Title

Behind the scenes, there are teams working hard to bring you to close! As the buyer, you are responsible for scheduling and attending any inspections, applying for your mortgage financing, obtaining homeowner’s insurance, ordering the appraisal, and obtaining title insurance. This is also when you may renegotiate terms with the seller if things came up during inspections that you’d like a credit for or to have the seller repair prior to closing. Don’t be alarmed– your realtor is there to help you along the way!

A special service I offer my clients is a customized calendar that walks them through the specifics of their deal– so they are fully aware of any upcoming deadlines.

Step 9: Obtain Funds for Closing

Three days before closing, buyers will receive the total amount they need to bring or wire funds for closing. You’re getting closer to the big day!

Step 10: Closing Day! You’re a Homeowner!

Congratulations! You did it! You’ll head to the closing, sign so much paperwork that your hand will cramp up, and get the keys to your new home.

If you’re considering starting the homebuying process– whether you’re looking to buy in the next month or the next year– reach out today and let’s get you started! It’s never too early to start familiarizing yourself with the market.

Tenille Metti Bowling

Realtor, Coldwell Banker Realty

Tenille.MettiBowling@cbrealty.com

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link